Revolutionized information discovery and drive insights from your unstructured data

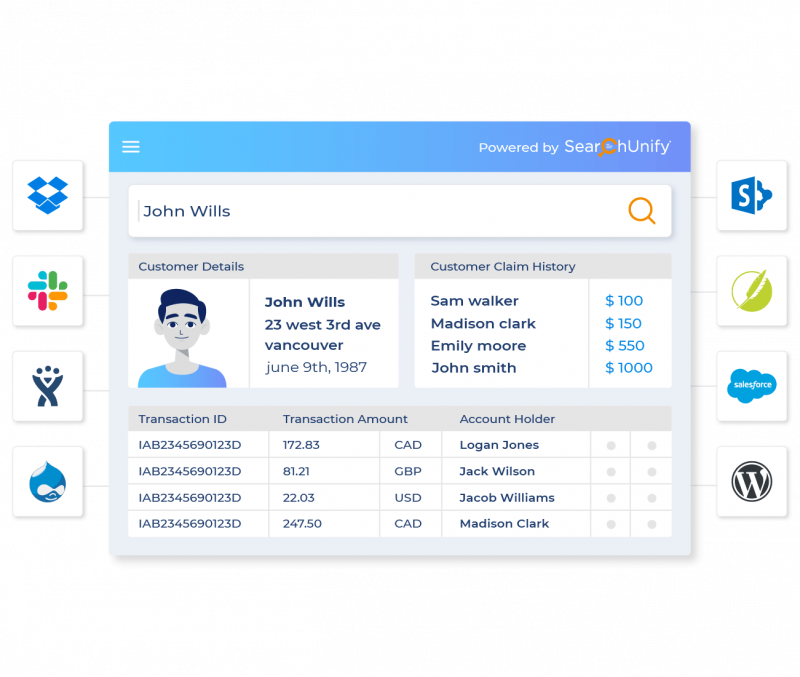

SearchUnify makes all the information about your policy applicants – information including payment history, risk profile, services availed etc. – easily searchable and accessible to your customer facing teams. This makes the process of verifying coverage from multiple documents less time extensive and in turn, lowers unit cost per processed claim as well as turnaround time.

Cognitive search helps in risk assessment, fraud detection and customer litigation settlement with content discovery from transactional data and digital interaction points around the number of claims, customer payment history, customer profiles, customer behavior around policy cancellations etc. You can uncover patterns such as payment anomalies and unusual activity in the customer transactions to identify potential defectors and proactively detect fraud.

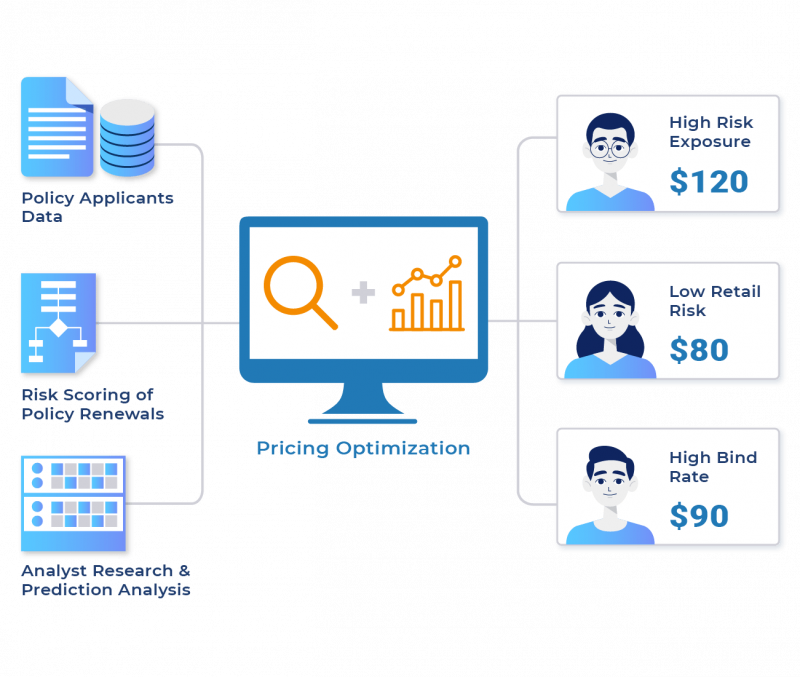

SearchUnify’s powerful insights engine helps your employees perform risk scoring to optimize product pricing by giving them insights into customer profile, risk history, financial spending etc. Underwriters can use machine learning to manage complex risk assessments and product pricing and to determine the most efficient employee follow-up actions.

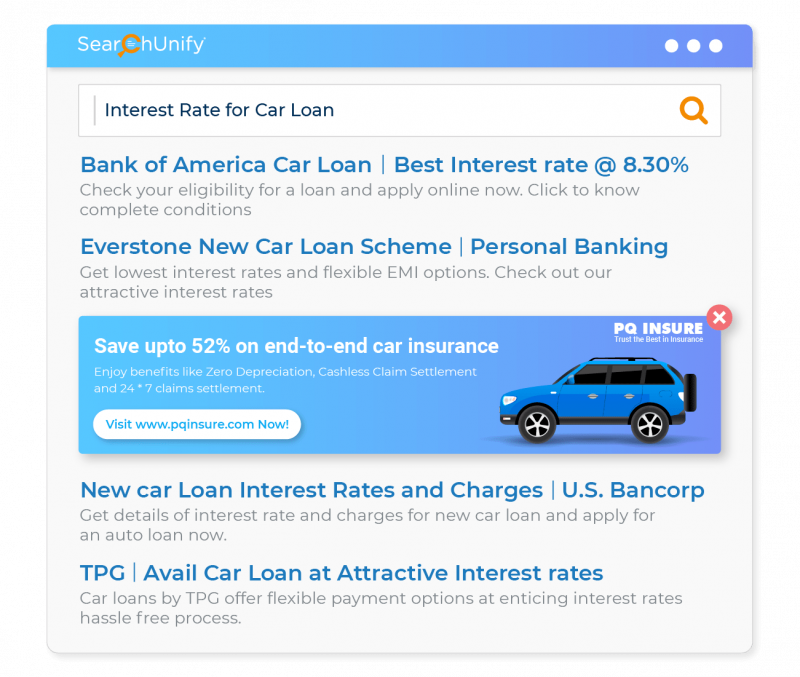

Natural language processing plays a major role in detecting relevant information in customers’ data and behavior. ML algorithms leverage historical data and this, in turn, helps employees suggest the best products for the customer based on their profile and needs. This data does not just help optimize your offerings but also personalize marketing campaigns and improve up-selling and cross-selling.

Cognitive search can help underwriters uncover the most important insights from policy applicants’ unstructured data to better evaluate risk and exposure and in turn, decide the price they should pay for the policy. For reinsurance, machine learning algorithms help insurers focus on the most critical risks associated with each policy renewal submission and help them in not only deciding the optimum price for reinsurance but also speed up submission handling.

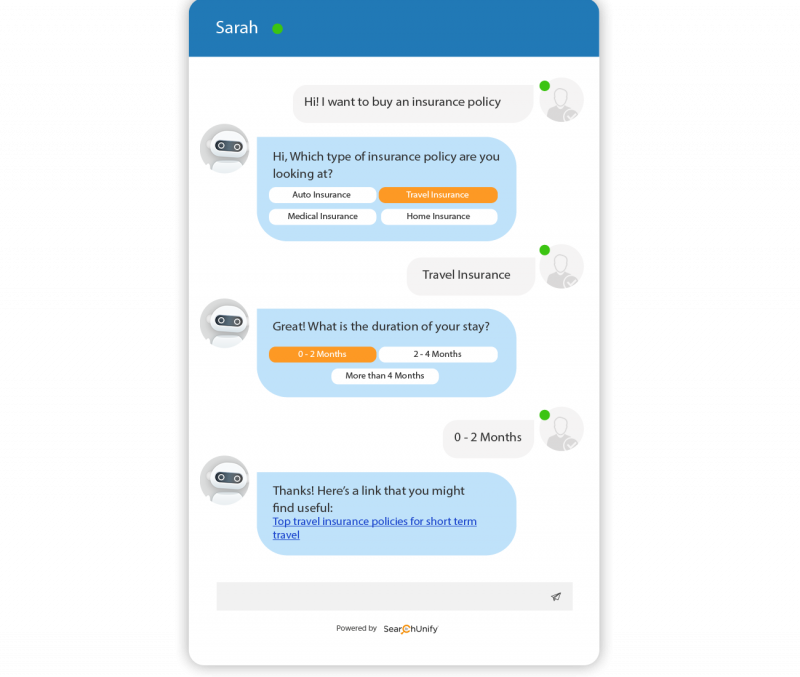

Search-powered chatbots can help you deflect L1 queries by answering regular questions of your customers about policies and premiers etc. That drives customer self-service and frees up your agents to focus on high value engagements with your customers and with cross-selling and upselling.